CSR Partnership

Be a Part of the Cause

Apply to Join

Be Socially Accountable - Contribute towards Nation Building Goals

CSR Partners

Increasing

Employee Engagement

A virtuous pledge of giving back to the society and community with CSR partnership evokes the sense of connecting within the employees, thus improving their engagement and productivity.

Engage

Make a Difference to

Communities at Local & Global Levels

When CSR cause is in line with the Company values, CSR gives the opportunity to set a broader vision to make a positive impact both locally and globally.

Support

Improving

Business Bottom-line

Many significant CSR programs and Digital CSR are known to help in impacting the bottom-line business financials.

Elevate

Establishing

Improved Employer Branding

Pursuing CSR programs is an excellent way of improving your corporate reputation and forming high moral ground as an employer.

Reputation

Improved

Business Bottom-line

Many significant CSR programs and Digital CSR are known to help in impacting the bottom-line business financials.

Elevate

Making

Press Opportunities

A CSR initiative can bring in new press spotlight on your business, in case you are struggling with it.

Spotlight

Joining Hands Together

Partners

We are thankful to our partners who have been supporting our causes wholeheartedly.

Our

Sign up & Take Action

Join us

Fill the following data accurately.

Ask Question

Frequently Asked Questions

FAQs

A company satisfying any of the following criteria during the immediately preceding financial year has to comply with CSR provisions specified under section 135 of the Companies Act, 2013 read with the CSR Rules made thereunder:

i. net worth of rupees five hundred crore or more, or

ii. turnover of rupees one thousand crore or more or

iii. a net profit (as calculated under Section 198 with other adjustments as referred in Rule 2(h) of CSR Rules.) of rupees five crore or more

The Central Government may give directions to a company or class

of companies as it considers necessary to ensure compliance of provisions of this section and such company or class of companies shall be required to comply with such directions.

The Ministry of Corporate Affairs vide Notification No. G.S.R. 40(E) dated 22nd January, 2021 issued the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021. The same has been made effective from the date of their publication in the Official Gazette i.e. 22nd January, 2021.

In accordance with section 135(1) of the Companies Act, 2013 (“the Act”), every company having net worth of rupees five hundred crore

or more, or turnover of rupees one thousand crore or more or a

net profit (as calculated under Section 198 of the Act with other

adjustments as referred in Rule 2(h) of CSR Rules.) of rupees five

crore or more during the immediately preceding financial year shall

constitute a Corporate Social Responsibility Committee of the

Board.

Further a new sub-section (9) inserted by Companies (Amendment)

Act, 2020 provides that where the amount to be spent by a

company does not exceed fifty lakh rupees, the requirement

under sub-section (1) for constitution of the Corporate Social

Responsibility Committee shall not be applicable and the functions

of such Committee shall be discharged by the Board of Directors

of such company.

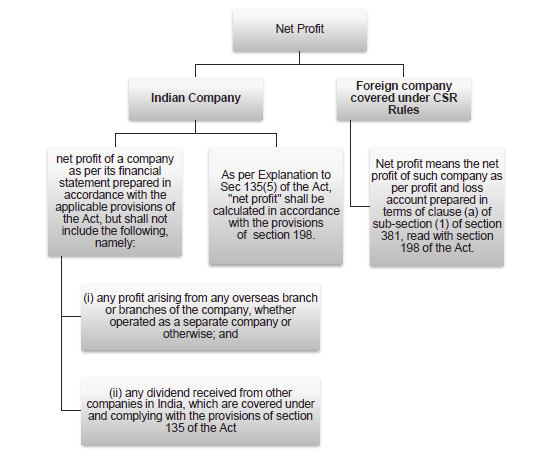

Computation of net profit for section 135 is as per section 198

of the Companies Act, 2013 which is primarily PROFIT BEFORE

TAX (PBT) with other adjustments as referred in Rule 2(h) of CSR

Rules. [Clarified by MCA vide General Circular No. 1/2016 dated

12th January, 2016]

As per Section 135(3) of the Act the Corporate Social Responsibility

Committee shall:

a) formulate a CSR Policy and recommend it to the Board,

which shall indicate the CSR activities to be undertaken by

the company;

b) recommend the amount of expenditure to be incurred on the

CSR activities;

c) monitor the CSR Policy of the company from time to time;

and

As per Rule 5(2) of the Rules-

The CSR Committee formulate and recommend to the Board, an

annual action plan in pursuance of its CSR policy, which shall

include the following:

a) the list of CSR projects or programmes that are approved to

be undertaken;

b) the manner of execution of such projects or programmes;

c) the modalities of utilisation of funds and implementation

schedules for the projects or programmes;

d) monitoring and reporting mechanism for the projects or

programmes; and

e) details of need and impact assessment, if any, for the projects

undertaken by the company:

For companies covered under Sec 135(9) and not having CSR

Committee these functions shall be carried out by the Board itself.

Applicability of provisions of Section 135 of the Act is company

specific. Hence, every company whether holding or subsidiary

satisfying the prescribed criteria shall comply with the provisions.

By mere relationship between two companies as Holding and

Subsidiary, shall not extend the applicable provisions to the other

company.

A Holding or subsidiary of a company falling within the ambit of section 135 of the Act, is not required to comply with section

135(1) unless the holding or subsidiary, as the case may be,

itself fulfills the criteria. [General Circular No. 1/2016 dated 12th

January, 2016]

For example: Company A is covered under the criteria mentioned

in section 135. Company B is holding company of company A.

Since, Company B by itself does not satisfy any of the criteria

mentioned in section 135, therefore Company B is not required

to comply with the provisions of section 135.

As per the provisions of section 135(5), if the Company has not

completed the period of three financial years since incorporation,

but it satisfies any of the criteria mentioned in section 135(1),

then it has to comply with CSR provisions. The Company will be

required to constitute a CSR committee and comply with other

requirements of section 135 including spending of at least two

percent of the average net profits of the company made during

such immediately preceding financial years since the date of

incorporation.

A company may undertake the implementation of CSR projects

through the following methods:

As per Rule 8(1) the Board’s Report of a company covered under

CSR rules pertaining to any financial year shall include an Annual

Report on CSR containing particulars specified in Annexure I or

Annexure II, as applicable.

In case of a foreign company, the balance sheet filed under clause

(b) of sub-section (1) of section 381 of the Act, shall contain an

Annual Report on CSR containing particulars specified in Annexure

I or Annexure II, as applicable.

In terms of Rule 9,the Board of Directors of the Company shall

mandatorily disclosel

the composition of the CSR Committee;

l CSR Policy and

l Projects approved by the Board on their website, if any, for

public access.

As a good governance practice, the Impact Assessment Report

may also be disclosed at the website.

In the Companies (CSR Policy) Rules, 2014, the term CSR has

been defined by way of enlisting of activities which shall not be

considered as CSR.

According to Rule 2(1)(d) “Corporate Social Responsibility (CSR)”

means the activities undertaken by a Company in pursuance

of its statutory obligation laid down in section 135 of the Act in

accordance with the provisions contained in these rules, but shall

not include the following, namely:-

i. activities undertaken in pursuance of normal course of

business of the company: Provided that any company

engaged in research and development activity of new

vaccine, drugs and medical devices in their normal course of

business may undertake research and development activity of

new vaccine, drugs and medical devices related to COVID-19

for financial years 2020-21, 2021-22, 2022-23 subject to the

conditions thata)

such research and development activities shall be

carried out in collaboration with any of the institutes or

organisations mentioned in item (ix) of Schedule VII to

the Act;

b) details of such activity shall be disclosed separately

in the Annual report on CSR included in the Board’s

Report;

ii. any activity undertaken by the company outside India except

for training of Indian sports personnel representing any State

or Union territory at national level or India at international

level;

iii. contribution of any amount directly or indirectly to any political

party under section 182 of the Act;

iv. activities benefitting employees of the company as defined

in clause (k) of section 2 of the Code on Wages, 2019 (29

of 2019);

v. activities supported by the companies on sponsorship basis

for deriving marketing benefits for its products or services;

vi. activities carried out for fulfilment of any other statutory

obligations under any law in force in India;

Further, the company shall give preference to the local area

and areas around it where it operates, for spending the amount

earmarked for Corporate Social Responsibility activities. This

provision has to be followed in letter and spirit. [General Circular

No. 06/2018 dated 28.05.2018]

The statutory provision and provisions of CSR Rules, 2014, are to

ensure that activities undertaken in pursuance of the CSR policy

must relate to Schedule VII of the Companies Act, 2013. The

entries in the said Schedule VII must be interpreted liberally so

as to capture the essence of the subjects enumerated in the said

Schedule. The items enlisted in the Schedule VII of the Act, are

broad-based and are intended to cover a wide range of activities.

It is for the Board of the company to take a call on this. [General

Circular No. 1/2016 dated 12th January, 2016 and General Circular

No. 21/2014 dated June 18, 2014 of MCA has clarified]

In terms of the provisions of Rule 8(3)(a) of the Companies

(Corporate Social Responsibility Policy) Rules, 2014 (‘Rules’),every

company having average CSR obligation of Rs. 10 crore or more

in pursuance of subsection (5) of section 135 of the Act, in the

three immediately preceding financial years, shall undertake impact

assessment, through an independent agency, of their CSR projects

having outlays of one crore rupees or more, and which have been

completed not less than one year before undertaking the impact

study.

Accordingly, the company is required to undertake impact

assessment of the CSR projects taken up or completed on or after

January 22, 2021.

As per Rule 2(1)(f) of the amended Companies (Corporate Social

Responsibility Policy) Rules, 2014.

“CSR Policy” means a statement containing the approach and

direction given by the board of a company, taking into account

the recommendations of its CSR Committee, and includes guiding

principles for selection, implementation and monitoring of activities

as well as formulation of the annual action plan.

As per provisions of Section 135(4) and Section 135(5) the Board

shall,—

a. approve the CSR Policy

b. disclose contents of such Policy in its report and also place

it on the company’s website, if any,

c. ensure that the activities included in CSR Policy are

undertaken by the company.

d. ensure that the company spends, in every financial year, at

least two per cent. of the average net profits of the company

made during the three immediately preceding financial years.

In terms of the provisions ofRule5(2) of the amended Rules, the

CSR Committee shall formulate and recommend to the Board,

an annual action plan in pursuance of its CSR policy which shall

specifically include:

a) the list of CSR projects or programmes that are approved to

be undertaken in areas or subjects specified in Schedule VII

of the Act;

b) the manner of execution of such projects or programmes;

c) the modalities of utilisation of funds and implementation

schedules for the projects or programmes;

d) monitoring and reporting mechanism for the projects or

programmes; and

e) details of need and impact assessment, if any, for the projects

undertaken by the company.

It is further provided that the Board may alter such plan at any

time during the financial year, as per the recommendation of its

CSR Committee, based on the reasonable justification to that

effect.

Accordingly, in the given case if the CSR project could be

completed and the amount of money left unutilised, be considered

by the Board for spending for other CSR projects / activities after

amending the Annual Action Plan accordingly. This fact should

also be disclosed in the CSR Report.

In terms of the provisions of Rule 2(d)(iv) of amended Rules, CSR

activities shall not include any activity benefitting employees of

the company as defined in clause (k) of section 2 of the Code on

Wages, 2019.

As per Clause 2(k) of the Code on Wages, 2019 “employee”

means, any person (other than an apprentice engaged under the

Apprentices Act, 1961), employed on wages by an establishment

to do any skilled, semi-skilled or unskilled, manual, operational,

supervisory, managerial, administrative, technical or clerical work

for hire or reward, whether the terms of employment be express

or implied, and also includes a person declared to be an employee

by the appropriate Government, but does not include any member

of the Armed Forces of the Union.

Hence medical camp exclusive for the unskilled labour hired by

the company shall not be permitted as a CSR activity.